Managed Currency Infrastructure for Gift Cards

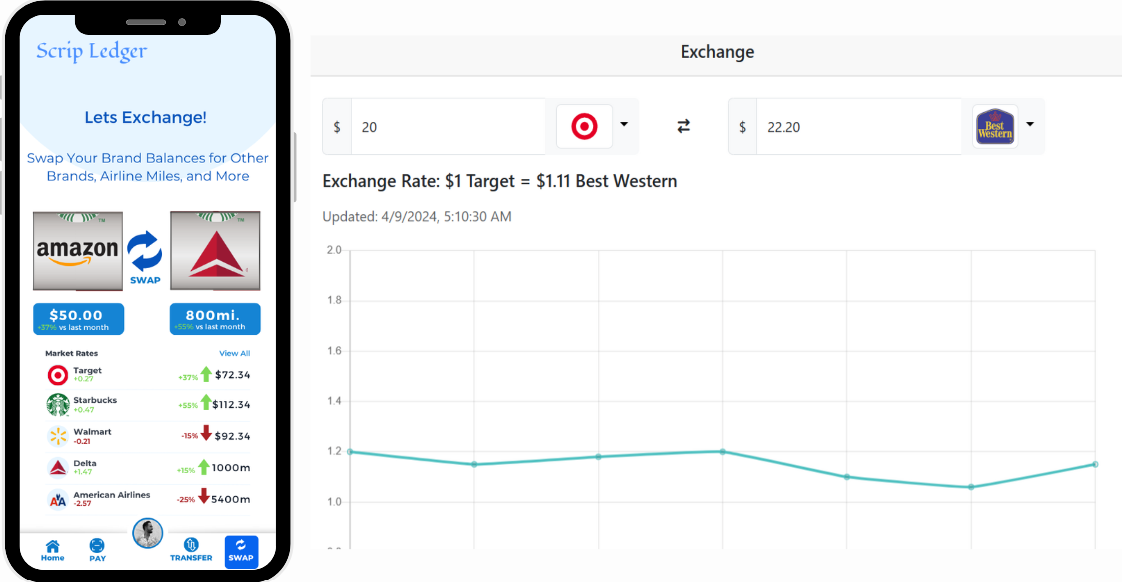

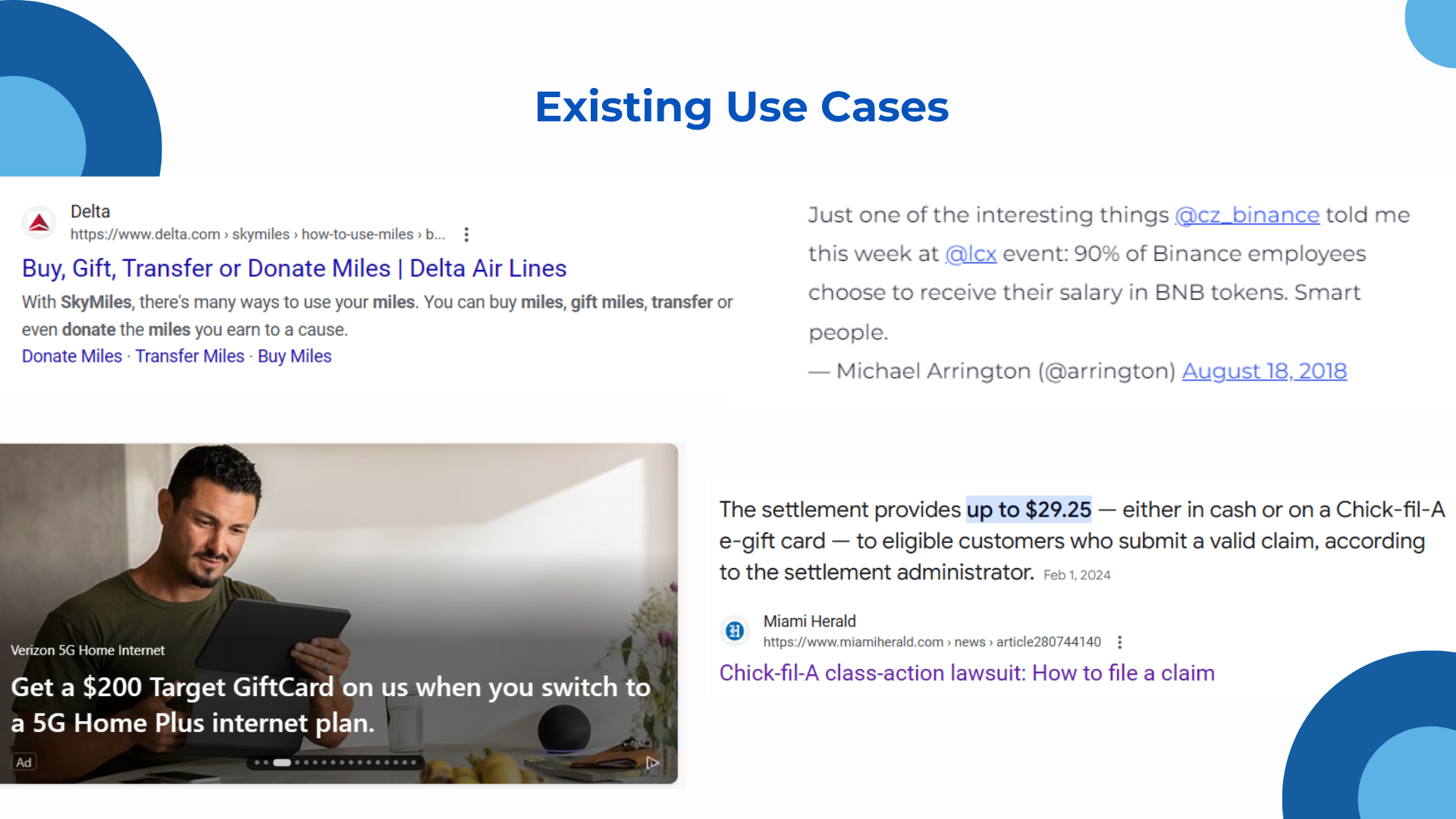

Gift card balances, airline miles, loyalty points are currencies issued by businesses, backed by their products and services. In the modern era, business currencies have been used for a range of purposes beyond gifting, such as charitable giving, payment of wages, legal settlements. They are important tools to reward brand loyalty, encourage consumption, generate new sales, and even raise capital.

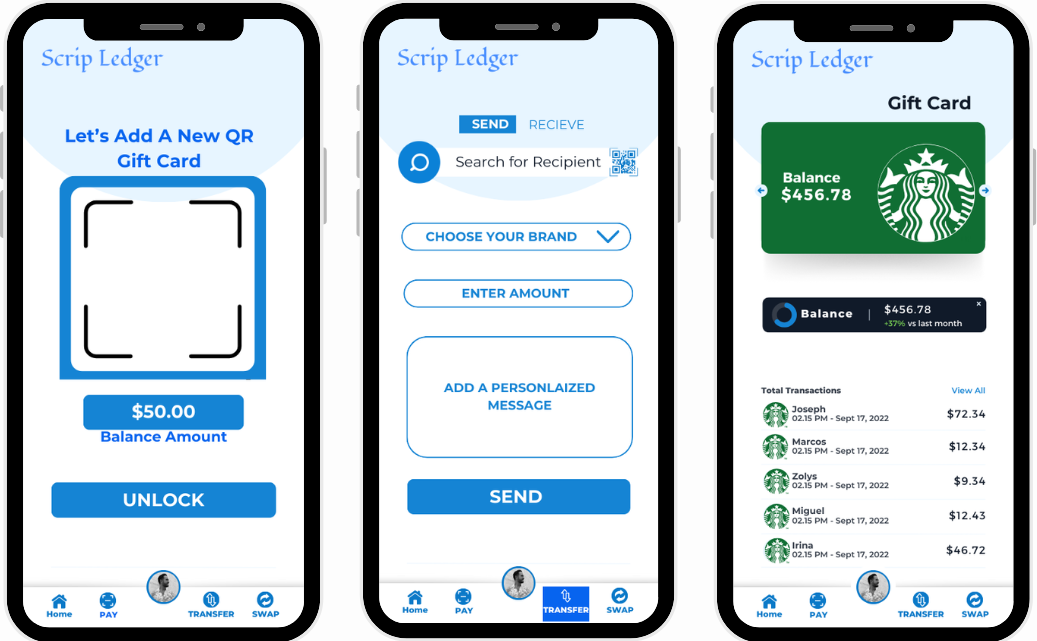

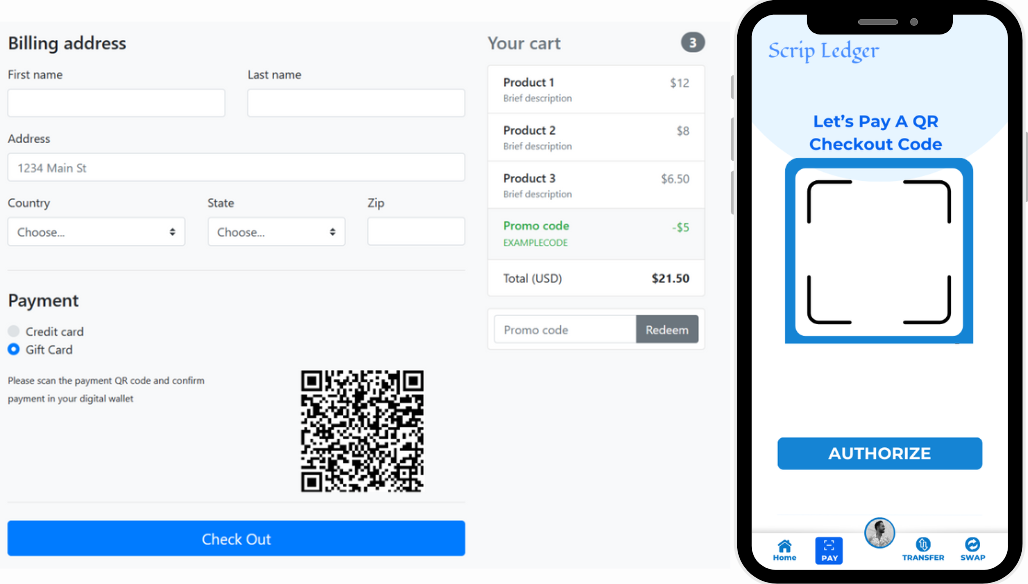

However, gift cards still run on archaic technology like Serial-PIN swipe cards, or siloed databases. It is difficult for consumers to do basic things like track or combine balances, recover lost funds, transfer balance. Secondary market, where secondhand gift cards are re-sold or exchanged, is rife with fraud.

An open, secure, and standardized gift card system on the blockchain can unlock tremendous value for consumers, businesses, and the economy.

For Consumers: